1099-NEC vs 1099-MISC | A Simple Explanation

1099-NEC vs 1099-MISC | What’s the difference? Do you need both?

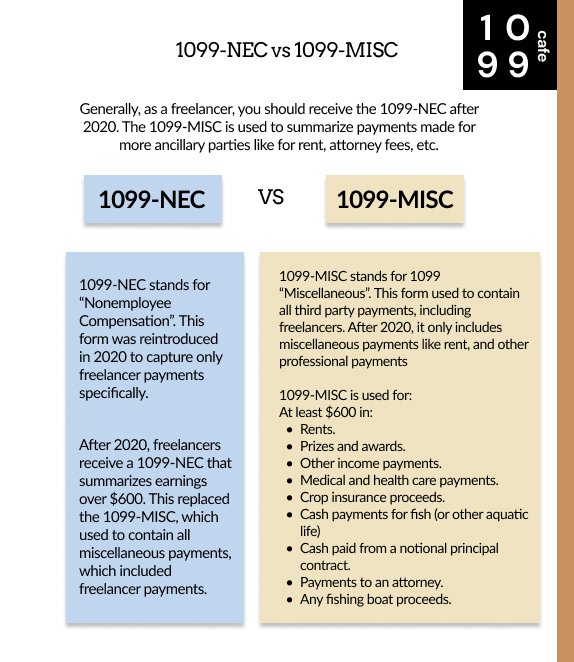

You may have heard that freelancers receive 1099 forms in order to file their taxes, but what’s the difference when it comes to 1099-NEC vs 1099-MISC?

In short, you should be receiving the 1099-NEC, not the 1099-MISC, after 2020.

The 1099-NEC is now the most updated form you should receive as a freelancer for payments over $600.

The 1099-MISC used to be the form for freelancer payments, but now only captures miscellaneous payments for things like rent, attorney fees, etc.

Let’s talk in detail.

quick summary of 1099-NEC vs 1099-MISC

What is the Form 1099-NEC?

A 1099 form details the amount of money you were paid by a client and you should receive one from each client that has paid you over $600 over the year. The “NEC” portion stands for Non-employee Compensation. This designation means that the money paid to you was not paid as an employee, but instead as a contractor/freelancer/gig worker. This is an important delineation, because when a worker is an employee, there are many implications whereas being a freelancer has fewer restrictions. At the same time, freelancers are considered self-employed and are responsible for paying self-employment taxes and potentially estimated quarterly taxes.

What is the Form 1099-MISC?

The 1099-MISC was essentially the same thing as the 1099-NEC and included contractor payments. “MISC” stands for miscellaneous, and the 1099-MISC is used to report any miscellaneous payments such as payments to contractors, rent, payments to professionals like attorneys, etc. However, payments to contractors have been separated to the 1099-NEC form since 2020.

In 2020, the 1099-NEC was reintroduced (it was once a form back in 1982) and is now used exclusively to document payments made for non-employee compensation. That means that prior to 2020, freelancers received 1099-MISC, and after 2020, freelancers started receiving 1099-NEC instead. So yes, you may have seen and received a 1099-MISC at some point, but know that it’s now the 1099-NEC specifically for freelancers.

So, Which Form Should I Receive? | 1099 Due Dates

Generally, if you are a freelancer and receive payment for your services, you should receive the 1099-NEC. The due date for 1099-NEC forms is January 31st, so make sure you check in with your clients if you haven’t received your 1099-NECs near the beginning of each year.

The 1099-MISC was used in the past to report freelancer payments, but no longer includes non-employee compensation. Today, you should receive a 1099-MISC for the following payment types (directly from the IRS website):

At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

At least $600 in:

Rents.

Prizes and awards.

Other income payments.

Medical and health care payments.

Crop insurance proceeds.

Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

Generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

Payments to an attorney.

Any fishing boat proceeds.

For most freelancers, none of these payments would typically apply. Unlike the 1099-NEC, the 1099-MISC has a different due date of March 31st, if filed electronically.

What to Do and How to File 1099 Forms | Simple Guide

Now that we’ve defined a few things, you might still be wondering what to do with all these forms and who should file them? Here’s a quick rundown:

As a freelancer, here are the steps you need to take to make sure your taxes are in order:

Send your client an up-to-date W9 form, if needed. This will provide your client with critical information about you, or your business. You can read more about the W9 vs 1099 forms here.

If you’ve made $600 or more from any client, make sure you receive your 1099-NEC by Jan 31st.

Use the 1099-NEC Forms you’ve received (they should be in physical paper form, or sent to you by email) to sum up your total income.

In your tax software, you should be prompted to add any 1099-NECs you may have received. You should add each 1099 separately with their corresponding information. For example, if you had 5 clients that paid you over $600, you should be entering information from 5 different 1099-NEC forms.

If you received 1099-MISC forms also, the steps are the same.

Who Needs to File Form 1099-NEC vs 1099-MISC?

Remember, the client (or whoever makes the payment for services) files the 1099-NEC or MISC, not you (receiving payment).

At the end of each year, clients will total up payments they made to individuals or businesses and send them a summary form–these forms are the 1099 forms. As a freelancer, you don’t need to file any 1099 forms. Instead, you will be inputting information from them during tax filing time.

FAQs:

Do I use 1099-MISC or 1099-NEC?

After 2020, generally freelancers should receive and use the 1099-NEC for filing taxes. The IRS reintroduced the 1099-NEC form to specifically capture non-employee compensation, or payments made to freelancers/independent contractors.

Did the 1099-NEC replace the 1099-MISC?

For payments to freelancers and contractors, in short, yes. The 1099-NEC was reintroduced in 2020 to capture non-employee compensation payments made to freelancers and independent contractors. This used to be reported on the 1099-MISC–now all payments made to contractors over $600 should be reported separately on the 1099-NEC.

What is a 1099-NEC form used for?

The 1099-NEC form is used to report Non-employee Compensation payments over $600. It summarizes payments made to independent contractors, or freelancers. If you’re a freelancer, you should receive a 1099-NEC form for each client you received over $600 from.