What is a Fixed Cost | Variable vs Fixed Expenses

If you’re currently a business owner, a freelancer, or thinking of carving your own path, it may be good to understand some important business principles that can help guide you make sound decisions. Business executives are always thinking of ways to cut or optimize costs, and today we’ll focus on a specific type of business cost, or expense. What is a fixed cost and how does it differ from any other business cost? Let’s find out.

What is a Fixed Cost? Achieving Economies of Scale

A fixed cost is just a way to label an expense.

Put simply, a fixed cost is something a business or individual paid for that is not directly associated with the production of a good or service.

For example, if you sell clothes online and you work out of an office and pay rent, that rent expense is not directly contributing to the production, or selling of your products (clothes). Therefore, it’s considered a fixed cost. Another simple method to determine if a cost is fixed is whether or not that cost will scale with volume (sales volume) i.e. if you sell more clothes online, will that cost increase as more clothes are sold? If not, then chances are that cost is a fixed cost. In general, fixed costs are compared to variable costs, another type of cost that behaves differently. The distinctions are extremely important and can inform a business owner on how to best grow their business. For example, since fixed costs remain the same regardless of volume, a business can its bottom line significantly if they can figure out how to drive volume up.

Additional Examples of Fixed Costs

Still using our online apparel store as an example, here are expenses that could be fixed costs:

Wages–you pay a project manager who is responsible for many facets of the business. His/her work is not directly related to the production or selling of clothes, even though her output benefits the business.

Insurance premiums–general business insurance for your wares, or even health insurance for owners and employees.

Utilities–payments for electricity, internet, not directly attributed to the production or selling of main products.

Meals and Entertainment–meeting with potential business partners and treat them out to a meal or coffee

Examples can help, but sometimes it’s important to understand the other types of costs. Earlier, we mentioned volume and perhaps you were wondering what is exactly meant by that? Let’s explore variable costs

What is a Variable Cost and What is Volume?

A variable cost is also another label for expenses.

Put simply, a variable cost is anything paid that directly contributes to the production or selling of a good or service.

For example, in our online clothing store, think about the raw materials and labor that are used to create the article of clothing. Whether you actually manufacture the clothing, or simply resell, those raw materials and labor are costs that are directly part of the final product.

Volume is simply the number of units sold, whether that be physical goods delivered, or services.

Let’s say we buy all of the clothes to resell. If you pay $8 for a shirt, that $8 consists of raw materials (cotton), labor (cost of running machinery), any other processes (printing, dyeing, etc.) and all of these inputs are considered a part of the total variable costs.

Additional Examples of Variable Costs

Again using our online clothing store as the example, here are expenses that could be variable costs:

Raw materials–the cotton that is used to produce a shirt.

Labor–the exact amount of cost related to labor to produce a shirt.

Transaction costs–your CMS platform charges you 2.9% plus 30 cents every sale you make to process credit cards.

Packaging and other collateral–any packaging that is directly related to the final product. I.e. the box you use to ship the clothing for every order. Or, tags you attach to each shirt.

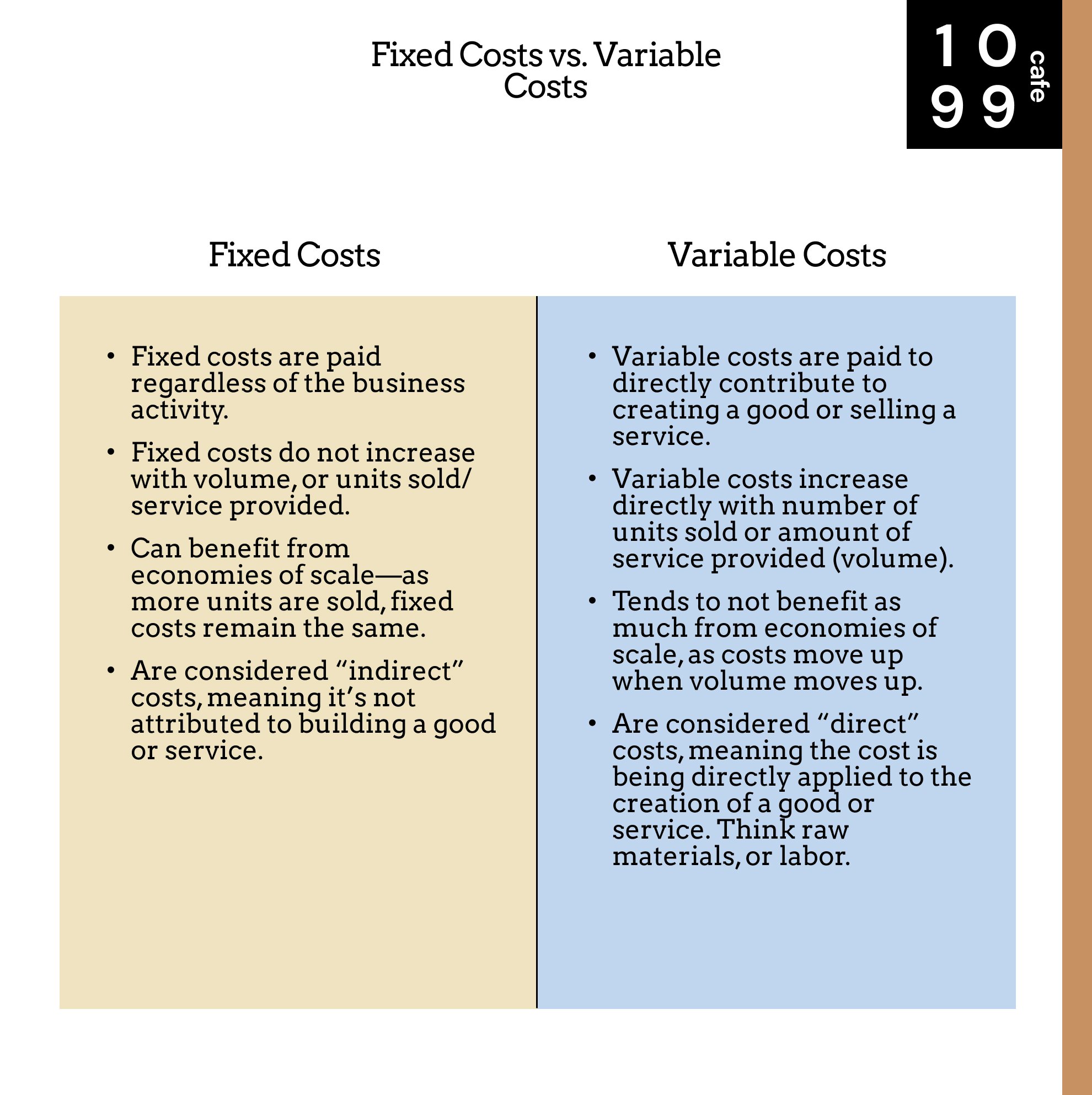

For a quick summary, here’s an infographic that summarizes the key differences:

A quick summary of fixed costs vs. variable costs

Now that you understand the difference between fixed costs and variable costs, let’s explore how they work in accounting.

How are Fixed and Variable Costs used in Accounting?

Fixed and Variable costs are just types of costs and generally you won’t see them broken down in the P&L or Income Statement this way. They are sort of like “filters” for analysis purposes, however, here’s a quick visual to help you understand where you might see fixed and variable costs:

Fixed Costs and Variable Costs, Visualized

some examples of fixed costs and variable costs on the P&L

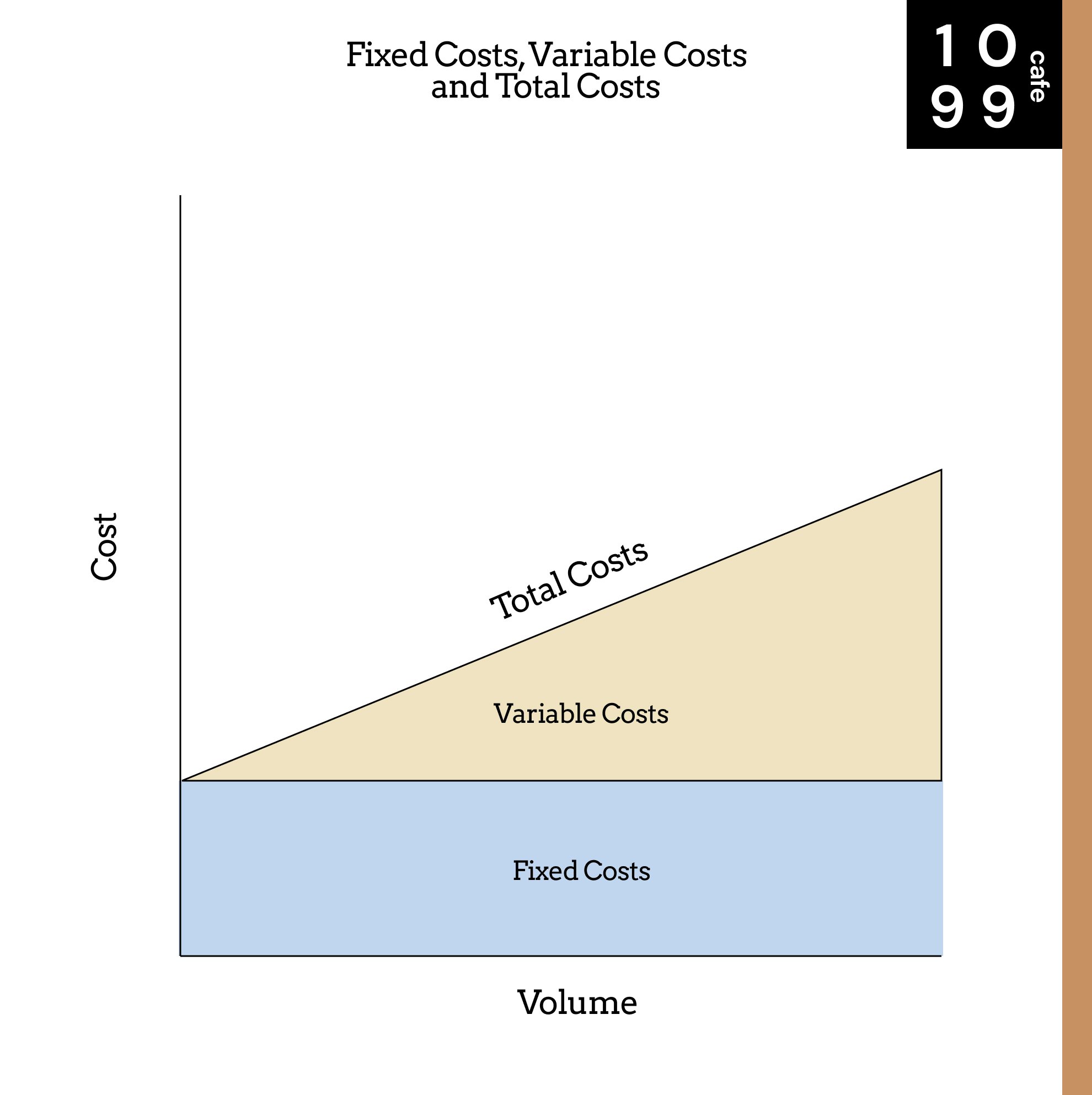

Additionally, a chart to help you understand the relationship between fixed costs, variable costs, volume and total costs:

The Relationship between Fixed Costs and Variable Costs

The relationship between fixed costs, variable costs and total costs

In summary, understanding how your costs are divided in your business can be key in helping your business grow. If you have a lot of fixed costs, it could be a wise business decision to focus on acquiring more volume, since those costs will remain the same and can be spread out over higher volume. If your variable costs are really high, perhaps you need to change your pricing model so your margins are not so thin.

FAQs:

What is a fixed cost and example?

Fixed costs are costs that do not change with volume. Examples include expenses like rent, insurance and wages–costs that do not change if you sell more product or services.

What are fixed costs simple definition?

Fixed costs are costs that do not change with volume. These are costs that not directly related to the production or selling of goods. For example, rent expenses.

What is fixed and variable costs?

Variable costs change with volume–the more units you sell, the more variable costs there are and vice versa. For example, raw materials cost.

Fixed costs, on the other hand, do not change with volume. Even if more units are sold, the cost remains the same. For example, rent expenses.