OnlyFans Taxes in 2024 | A Comprehensive Guide

You might think freelancers only exist in more traditional industries like graphic design, photography, or accounting. However, as the digital age continues to grow, the freelancing industry has expanded to a variety of industries. As an OnlyFans content creator, you’re considered self employed and a freelancer. You may be wondering how Onlyfans taxes work and what implications there are. Today, we’ll cover the necessary forms and processes step by step to help you grow your OnlyFans career

How to File Your OnlyFans Taxes

Filing your OnlyFans taxes is no different than filing taxes as any other type of content creator, freelancer, or self employed individual, so don’t let the vocabulary and processes confuse you!

To put it simply, here is generally what you’ll need to file your taxes as an OnlyFans content creator:

1099-NEC forms from OnlyFans—sent to you, or downloaded from your account

1099-K forms from payment providers like PayPal if you accept payment for content outside of OnlyFans—sent to you, or downloaded from your payment account

A record of expenses that incurred and can be deducted from your income to lower taxes. For example, your camera setup—if you have a business credit card, this would be the easiest way to keep track, by keeping all business expenses on this card. Otherwise, you have to rely on your own organization

Technically, the forms:

Form 1040—your main tax return form, contains all information

Form 1040-ES—helps you calculate estimated tax payments, if needed

Schedule C—details out your “business” income and expenses

Schedule SE—helps you calculate how much Self Employment Tax you owe

Don’t worry too much about how to fill out the above forms, as they’re generally guided by a tax software, like TurboTax.

Here’s a quick summary of the forms and their use:

| Form Type | What it does | Who does what | Why you need it |

|---|---|---|---|

| 1099-NEC | The most modern form type for freelancer payments. You receive this from clients if they've paid you over $600 | You receive this from clients | You should receive a 1099-NEC from each client, and it summarizes the total amount you've received from each client. You need this know your income and to file your taxes |

| 1099-MISC | The legacy 1099 form that used to be sent out. Some clients may still send this form out incorrectly, but you should be receiving the NEC instead. 1099-MISC is correctly sent out for payments that have to do with rent, royalties, attorney fees, more obscure payments. | You receive this from clients | This is a legacy 1099 format--starting in 2020, you should no longer receive a 1099-MISC for regular freelancing payments. Unless you are receiving payment for obscure services like rent, attorney fees, prizes, royalties or interest, you shouldn't receive a 1099-MISC. If you do receive one, it is used to summarize payments and to file taxes. |

| 1099-K | Same function as a 1099-NEC, but A different type of 1099 that you may receive from payment providers like PayPal, or Venmo, or Stripe. If your payments are processed through a provider, they will be the ones to send you a 1099-K, instead of the client. | You receive this from payment providers | You should receive this if your freelancing pay was processed through a payment provider. As a facilitator of payments, companies like PayPal have to aggregate and send out 1099s, called 1099-K. These are used in the same way 1099-NECs are used, they just come from payment providers and not the client themselves. |

| W9 | A form you send to clients for them to have your information. Info includes name, address, and an identification number like EIN or TIN. | You send this to clients | You send the W9 form to clients to give them information about yourself, or your business. Information will include name, address and an identification number like EIN or TIN. |

| 1040 | The summary tax form that you will submit to the IRS which details every aspect of your taxes from the top line (income), to your expenses, to taxable income, and to your bottom line. | You send this to the IRS | The 1040 is the official "tax return" document that details every line item on your tax return. This is what gets sent to the IRS as the main document, in conjunction with some add on forms. You would send this digitally via a software like TurboTax, or physically in paper form if you prefer. |

| 1040-ES | A separate form you fill out in order to estimate the amount of quarterly tax payments you need to make throughout the year. | You use this to calculate estimated tax payments | This is an add-on to the 1040 form, and serves as a calculation form to estimate your quarterly tax payments. Read our Quarterly Tax Payments section to learn specifics. Usually, this form will be auto populated as you go through guided steps from your tax software, like TurboTax. |

| Schedule C | An add-on to the 1040 that details out your business expenses that you are claiming. For example, you purchased a desk for work, that expense would show up here. | You use this and attach to Form 1040 to detail out your freelancer deductions | This is an add-on to the 1040 form, which details out your business income and deductions, line by line. It would show eligible business expenses that you incurred to operate your business--for example, buying a desk. This is generally auto populated as you go through the step-by-step nature of a tax software like TurboTax. |

| Schedule SE | An add-on to the 1040 that details how much you need to pay in self employment tax. | You use this to calculate how much self employment tax you owe | This is an add-on to the 1040 form, which acts as a calculation sheet to determine how much Self Employment tax you owe. It is generally automatically calculated via software. |

How to Pay Your OnlyFans Taxes: Step-by-Step Guide

Once you feel ready and you’re comfortable with the terms and forms, here is the step-by-step guide to OnlyFans taxes:

Download your 1099-NEC from your OnlyFans account. If you haven’t made more then $600, you may not have a 1099-NEC from OnlyFans. However, you still need to report the income—you do this by entering it directly as part of your Schedule C.

Download your 1099-K from other payment providers, if you have income from content outside of the OnlyFans platform. Examples include PayPal, Venmo, CashApp, etc.

Find a tax software that you find easy to use and like—for example, TurboTax, FreeTaxUSA, H&R Block

Begin the tax filing process in your tax software. Generally, everything will flow onto your Form 1040

Answer a series of questions in your tax software, be sure to read each question carefully. You should expect to answer yes for questions that look something like these:

“Do you have income to report on 1099 forms?”

Answer Yes—this is where you will input your 1099-NEC forms and also your 1099-K forms.“Do you have business income or expenses to report?”

Answer Yes—even though you may not consider yourself a “business”, the IRS considers self employed and freelancers a business for tax filing purposes

Be sure to have an accurate and organized record of your “business” expenses. These go on the Schedule C and you input the numbers for each category. These numbers are then subtracted from your income, which lowers your taxes. For OnlyFans taxes, common deductions include:

Equipment for content creation—think camera, lenses, camera equipment

Software for content editing—think Adobe products

Portion of rent—the portion of your home or apartment that you rent or pay for where you dedicate that space for OnlyFans content. For example, if there’s a studio that is 20% of the total square footage of your place that you use exclusively for content creation, then you can reasonably expense 20% of your total rent or mortgage payment

Supplies—if you purchased props, decorative items, backgrounds for filming/content creation, these items can be expensed

Advertising—if you have ad spend in order to promote your content or brand

Health and wellness—as is necessary for your audience, perhaps you have expenses that help you maintain your image or brand

Phone, internet or utilities—the portion of communications, hosting, upload/download needs for your OnlyFans account. For example, you use the internet 50% of the time to support the upload, creation, or editing of your content, then you could reasonably deduct 50% of your internet bill

Travel and lodging—if you had a reasonable expense to travel, or stay somewhere in order to create unique content, those expenses are eligible as deductions

Half of what you paid in Self Employment Tax—you can take half of what you pay in FICA, or Self Employment Tax, as a deduction

Related article: What is a write-off? In-depth explanation of deductions and business expenses

7. Your tax software will aid in filling out Schedule SE—which will determine how much Self Employment Tax you owe.

8. Your tax software will also aid in filling out 1040-ES—which will determine how much you may need to set aside for Estimated Quarterly Tax Payments. Don’t worry about this if you are just starting out and don’t make significant income from OnlyFans (>$10,000).

9. Lastly, don’t worry too much! Many of the steps are completely guided in the tax software—you won’t have to manually write in anything on paper, or mail anything in. Nowadays, 90% of the work is digital and automated

Additional Topics in OnlyFans Taxes in Detail

If you’ve gotten this far, you’re probably good to go on your OnlyFans taxes. However, if you’re wondering about additional details, or just want to learn more—we cover some topics in detail and answer common questions in the following sections.

What is Self Employment Tax? Am I Getting Taxed More on OnlyFans?

Self Employment Tax is not exclusive to OnlyFans, it’s a term used to refer to the full portion of FICA tax—this is a tax that is generally withheld from your paycheck, if you had a full-time job.

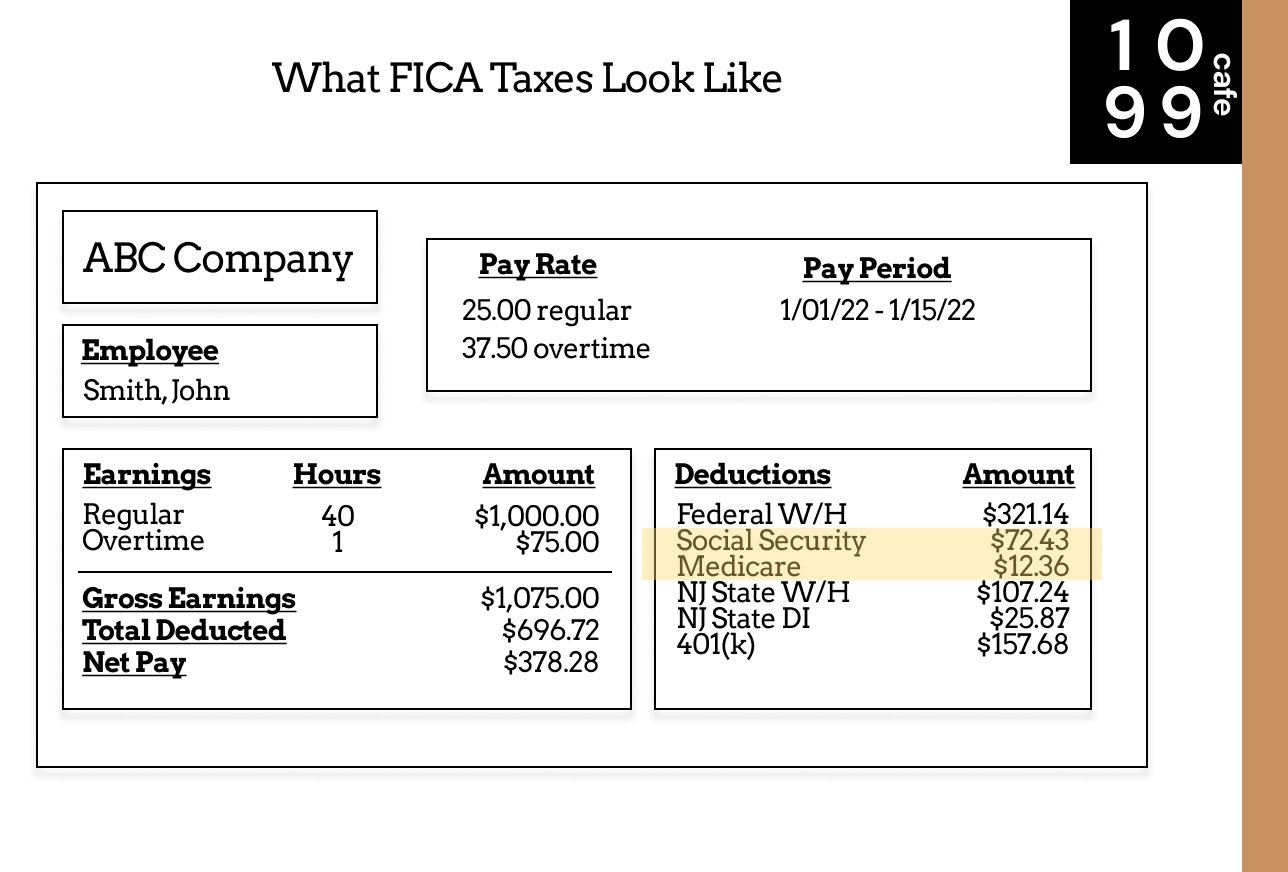

If you’ve ever received a paystub, you may have noticed that money was held for Social Security and Medicare, that’s FICA. Self Employment Tax is FICA, but at double the amount. The reason being—employers typically pay half of the FICA tax, so if you’re self employed you need to pay for both halves, since you are “both the employer and the employee”.

Highlighted: FICA taxes

When you owe Self Employment Tax, it just means you owe FICA taxes—twice as much as you would owe if you worked for an employer. However, as self employed individuals, you are allowed to deduct half of what you pay in Self Employment taxes as an expense. So in effect, you don’t really pay that much more in taxes. In fact, you may pay less taxes overall than full-time employees since there are many other business expenses that you can deduct, as we illustrated in the previous section.

What are Estimated Quarterly Tax Payments? Do I Need to Make Them?

Estimated Quarterly Tax Payments are what they sound—payments to offset the amount of tax you might owe. As freelancers or self employed individuals, we do not have taxes withheld from our paychecks like full-time employees. When we get paid, we get paid the full amount and no taxes are taken out. We still need to pay taxes on that income, but it’s our responsibility.

If you make enough money through freelancing or self employed means, whether that’s with OnlyFans or not, you should be making Estimated Quarterly Tax Payments. That’s because the IRS does not want you to owe a ton of taxes and only pay it at the end of the year—the government wants to you pay taxes on income, as you earn it.

To make an estimated payment:

You first estimate your annual income, minus all estimated expenses from all freelancing sources, then multiply the taxable income by the Federal tax rates. This is how much is estimated that you owe

You then go on the official government portal called DirectPay, make an account

Pay the estimated tax owed amount / 4 each quarter.

You also should make estimated tax payments on the state level. Due dates will differ by state, but the process is the same, just use the state tax rates instead of the federal ones.

The Federal estimated tax payment due dates are below:

| Period | Due Date | For Months |

|---|---|---|

| 1st Quarter | April 15th | January - March |

| 2nd Quarter | June 15th | April - June |

| 3rd Quarter | September 15th | July - September |

| 4th Quarter | January 15th, of next year | October - December |

FAQs:

Do I have to pay taxes if I have OnlyFans?

Yes—you have to pay taxes on any income you make. This includes income made directly on the OnlyFans platform like subscriptions, pay per view, tips and donations, and also income off the OnlyFans platform like payment for special content on PayPal. Keep in mind that you’re generally allowed to take business deductions against your OnlyFans income to lower your taxes.

Does OnlyFans send you a 1099?

Yes—OnlyFans should send you a 1099-NEC if you’ve made more than $600 on the platform. If you made less than $600, you may not receive the 1099-NEC tax form. However, you still need to report that income even without a 1099.

How do I prove my income OnlyFans?

To prove your OnlyFans income, simply download your 1099-NEC form from your account. You can also download a Proof of Income document on your Earning Statistics page.

A digital copy of your 1099 form can be downloaded from your Banking page. Proof of income can be found on your Earning Statistics page.